Organizational Design Strategies for Streamlining Post-Merger Operations

Post-merger operational strategies focus on aligning structures, decision rights, and technology to enhance efficiency—discover the secrets to seamless integration next.

Post-merger operational strategies focus on aligning structures, decision rights, and technology to enhance efficiency—discover the secrets to seamless integration next.

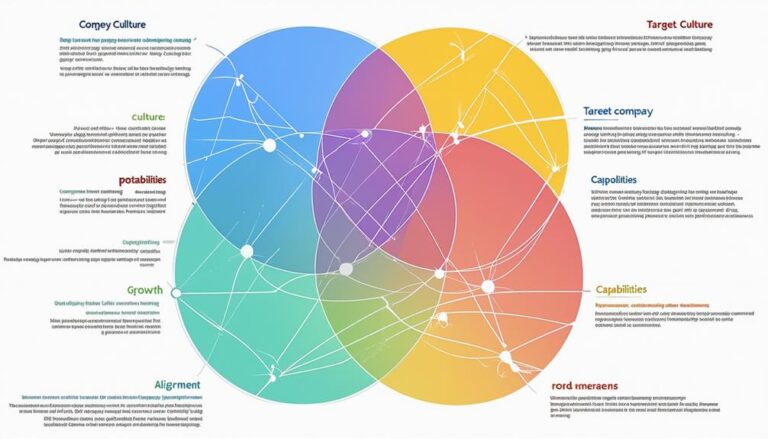

How can understanding and addressing cultural differences streamline post-merger integration for seamless organizational cohesion? Discover effective strategies to ensure success.

Discover why post-merger integration is crucial for M&A success and how it can make or break your deal's potential—read on to learn more.

Optimizing employee retention in post-merger integration is crucial for stability and success—discover key strategies to maintain talent and drive your business forward.

For a successful merger, uncover the secrets of cultural due diligence and avoid pitfalls that jeopardize employee retention and integration—read on to find out how.

Uncover essential strategies for crafting a seamless communication plan post-merger to ensure smooth transitions and lasting success—keep reading to master integration.

Want to ensure post-merger success? Discover key strategies for performance measurement that guarantee financial and organizational excellence.

Boldly uncover the strategic advantages and synergistic benefits that define successful M&A outcomes through our comprehensive approach to evaluating target fit and value creation.

You won't believe how navigating antitrust laws and regulations can make or break a merger; discover the key elements that could save your business.

Fundamental to successful mergers and acquisitions, strategic analysis and decision-making in pre-deal planning ensure long-term value creation through a thorough understanding of the target company's…

End of content

End of content