Pros and Cons of Vertical Mergers

Vertical mergers can bring about significant advantages for businesses, such as economies of scale, improved supply chain management, and enhanced product development. By integrating different stages of production or distribution, companies can streamline operations and reduce costs, leading to increased efficiency and profitability. This consolidation can also provide better control over the quality and timing of inputs, ultimately benefiting the end product or service.

However, it is essential to recognize the potential drawbacks of vertical mergers. One concern is the increased market power that a merged entity may hold, potentially leading to anti-competitive behavior and higher prices for consumers. Additionally, integrating different parts of the supply chain can present challenges in terms of communication and coordination within the organization. Ensuring that these issues are addressed effectively is crucial to the success of a vertical merger.

Balancing the benefits of vertical integration with the need for competition and innovation is key for businesses considering this strategic move. Forward integration can lead to greater control over the customer experience and increased market presence, while consolidated operations can drive efficiencies and cost savings. However, it is important to remain mindful of maintaining a competitive market environment and fostering a culture of innovation to continue driving growth and success.

By carefully weighing the advantages and potential risks of vertical mergers, businesses can make informed decisions that align with their strategic objectives. It is essential to thoroughly evaluate the market dynamics, regulatory environment, and internal capabilities before pursuing such a merger. With the right approach and thoughtful consideration, companies can leverage the opportunities presented by vertical integration while mitigating any associated challenges.

Key Takeaways

Vertical mergers can bring about economies of scale, cost efficiencies, and improved control over the supply chain, which can enhance production and distribution processes. This integration allows companies to streamline operations and better coordinate activities across different stages of the production cycle.

On the flip side, vertical mergers can raise concerns about potential monopoly or monopsony power, where a single entity has a significant influence over pricing and market competition. This concentration of power can limit choices for consumers and stifle innovation in the industry. It is important for regulatory bodies to monitor these mergers closely to ensure fair competition and protect consumer interests.

Effective communication and collaboration within the merged firm are essential to address structural differences and align operational priorities. This synergy can help overcome challenges that arise from integrating different parts of the supply chain and ensure a smooth transition towards a more integrated and efficient organization.

By vertically integrating through forward integration, companies can strengthen their market position and reduce reliance on external suppliers. This strategic move can provide more control over the production process and improve the overall competitiveness of the merged entity in the market.

However, disintermediation in vertical mergers may lead to cost-cutting and improved efficiency, but it can also create barriers to entry for new competitors, limiting innovation and competition in the industry. It is crucial for companies engaging in vertical mergers to strike a balance between efficiency gains and maintaining a level playing field for all market players.

Economies of Scale and Cost Efficiencies

Vertical mergers bring together different parts of a business to create cost efficiencies and economies of scale. By combining resources and operations that complement each other, these mergers can lower overall production costs. This is achieved by streamlining processes, eliminating duplicate functions, and optimizing supply chain management.

Through vertical integration, companies can benefit from bulk purchasing, integrated production, and coordinated distribution channels. This maximizes asset utilization and reduces waste in the supply chain. By aligning operations, companies can leverage their combined size and scale to drive down costs per unit.

Vertical mergers offer a unique opportunity to improve competitive positioning by realizing significant cost savings. As processes are streamlined and redundancies are eliminated, it opens up new possibilities for innovation and investment. This positions organizations for long-term growth and success.

Enhanced Supply Chain Control

Vertical mergers bring together different stages of production within one company, giving us more control over the entire supply chain. This control helps us to better coordinate operations, improve efficiency, and adapt quickly to market changes. With a tightly integrated supply chain, we can optimize processes, ensure product quality, and boost our competitiveness in the market.

Having ownership over multiple stages of production allows us to align strategies and make decisions that benefit the entire supply chain. This alignment reduces delays, minimizes disruptions, and enhances overall performance. By consolidating our operations vertically, we can achieve greater economies of scale and drive down costs, ultimately leading to increased profitability.

In addition to operational benefits, vertical mergers also give us a strategic advantage in the market. With a more streamlined supply chain, we can respond faster to customer demands, launch new products more efficiently, and stay ahead of competitors. This proactive approach to managing the supply chain positions us for long-term success and growth in the industry.

Coordinated Production Processes

Coordinating production processes through vertical mergers allows us to consolidate supply chain control, making operations more efficient and less complex. By integrating various stages of the supply chain, we can enhance coordination, communication, and overall production efficiency. This integration helps us manage quality control, costs, and resource utilization more effectively. With improved visibility into the entire production process, our decision-making abilities and overall control are significantly enhanced.

Vertical mergers enable streamlined production processes that eliminate redundancies and inefficiencies. Leveraging synergies across the supply chain leads to increased efficiencies and cost reductions. This integrated approach provides us with tighter control over the production lifecycle, ensuring consistent quality and timely delivery to our customers.

Through coordinated production, we can make better, data-driven decisions that optimize the supply chain. This strategic control allows us to be more responsive to market demands, strengthening our competitive position. As we continue to innovate our production processes, vertical mergers emerge as a potent tool for superior supply chain management.

Streamlined Distribution Channels

When companies merge vertically, they combine different stages of the supply chain, like manufacturing and distribution, under one roof. This integration helps them control the entire process more efficiently. By doing this, companies can save money and deliver products faster.

Vertical mergers offer several advantages. First, they improve coordination within the supply chain, allowing companies to respond quickly to market changes. Second, they give companies better visibility and control over the entire distribution process. This means they can track products from the moment they're made to when they reach customers.

Another benefit is the ability to take advantage of economies of scale. This means that by merging different parts of the supply chain, companies can reduce costs and optimize how products are transported and delivered. Customers also benefit from a more seamless experience, as the supply chain becomes more integrated.

In today's competitive business environment, where innovation is crucial, having control over the supply chain is key. Vertical mergers enable companies to operate more efficiently, save money, and adapt faster to changes in the market. This gives them a significant edge over their competitors.

Improved Product Development Capabilities

Vertical mergers have the potential to boost our product development capabilities by combining diverse knowledge and resources. This integration allows for the creation of innovative product designs and features. By merging different technologies and expertise from various stages of production, we can utilize specialized skills and technologies across the supply chain to expedite product launches. This consolidation of research and development efforts streamlines the product development process, enabling us to introduce cutting-edge products to the market more swiftly.

Moreover, vertical mergers facilitate collaboration among previously separate teams, enhancing cross-functional communication for superior product outcomes. Accessing a broader range of expertise and perspectives can result in truly groundbreaking product designs that captivate our customers. Ultimately, integrating production, supply chain, and product development resources through vertical mergers empowers us to develop products that establish new industry benchmarks and solidify our position as innovation leaders.

Coordination and Operational Efficiency

Vertical mergers can boost coordination and operational efficiency by aligning various stages of production within one company. This alignment can lead to better communication, streamlined processes, and increased productivity.

Streamlining Operations

Vertical mergers streamline operations by improving coordination across different production stages, boosting operational efficiency. The enhanced coordination optimizes resource allocation, eliminates redundancies, and simplifies decision-making processes.

When previously separate entities communicate better post-merger, it creates a cohesive and aligned organizational structure. This alignment drives productivity and enhances customer satisfaction, leading to cost savings and quicker response times.

These efficiency gains provide a competitive edge in the market, as the merged entity can outperform its rivals. By streamlining operations, vertical mergers pave the way for sustained growth and success in the business landscape.

Leveraging Synergies

By harnessing the synergies between different production stages, vertical mergers can enhance coordination and improve operational efficiency. Businesses today are constantly seeking ways to streamline their supply chain and cut costs, and vertical mergers offer numerous benefits in this area.

By merging complementary strengths and resources, we can optimize supply chain management and boost overall performance. This improved coordination leads to quicker decision-making, swifter response times, and increased competitiveness in the market.

Synergies in vertical mergers also result in cost savings by reducing duplication and improving communication. Furthermore, better oversight of the production process can elevate productivity and quality.

Ultimately, the strategic coordination and operational efficiency achieved through leveraging synergies in vertical mergers serve as potent tools for companies aiming to gain a competitive edge in their industry. We're confident that the fresh opportunities brought about by vertical mergers will continue to attract forward-thinking companies looking to maximize the benefits of vertical integration.

Monopoly or Monopsony Power Concerns

Vertical mergers raise concerns about monopoly or monopsony power, which stem from the potential of a merged company to dominate a specific market. This dominance could lead to reduced competition, resulting in higher prices for consumers or lower revenue for suppliers. Regulators keep a close watch on vertical mergers to prevent any abuse of monopoly or monopsony power in the market.

When a merged entity gains monopoly power, it becomes the dominant player in the market, potentially limiting choices for consumers and leading to increased prices. On the other hand, monopsony power arises when a merged entity controls the buying power, restricting options for suppliers and potentially stifling innovation and competition.

Companies entering into vertical mergers need to be aware of these power concerns and work closely with regulators to ensure a fair and competitive marketplace that encourages innovation. By addressing these issues proactively, companies can contribute to a market environment that benefits both consumers and suppliers.

Reduced Competition and Consumer Choice

When companies merge vertically, they combine different stages of production under one ownership. This can have a significant impact on competition and consumer choice in the market. By controlling multiple production stages, companies may limit competition, resulting in fewer options for consumers. This could lead to higher prices as the lack of alternatives reduces market contestability.

Vertical mergers have the potential to discourage new entrants into the market, as established players with integrated operations may have a competitive advantage. This lack of competition can also stifle innovation and limit product diversity, as dominant companies may have less incentive to explore new ideas or cater to niche consumer preferences.

Policymakers and regulators need to carefully consider the implications of vertical mergers to ensure a balance between efficiency and market competition. While these mergers can offer operational efficiencies, they mustn't come at the cost of consumer welfare and vibrant, competitive markets. It's crucial to foster an environment that encourages both business success and consumer empowerment through a diverse range of choices and fair competition.

Communication Challenges Within Integrated Firms

After a vertical merger, communication challenges often surface within integrated firms. Coordinating activities across distinct verticals can be complex, leading to the formation of information silos that hinder teamwork and decision-making processes.

Overcoming these obstacles necessitates the implementation of proactive strategies to promote shared objectives, defined roles, and effective communication frameworks throughout the combined organizations.

Coordination Across Divisions

When integrated firms undergo vertical mergers, it's vital to ensure smooth coordination across divisions. Communication challenges may arise due to differing priorities, cultures, and operational structures within the organization. These challenges can lead to misunderstandings, decision-making delays, and conflicts between divisions, ultimately affecting the efficiency and performance of the merged entity.

To enhance coordination post-merger, it's crucial to establish clear communication protocols and channels for seamless information flow between divisions. Aligning strategic objectives and key performance indicators (KPIs) throughout the organization can foster a shared sense of purpose among teams. Encouraging cross-functional collaboration through joint projects, shared resources, and interdepartmental meetings can also facilitate coordination and integration across divisions.

Investing in training and team-building initiatives is essential to cultivate a unified organizational culture and mindset. By promoting a collaborative environment and emphasizing the importance of working together towards common goals, integrated firms can overcome communication challenges and enhance the overall effectiveness of the merged entity.

Information Silos Emergence

One risk associated with integrated firms engaging in vertical mergers is the development of information silos between various departments or stages of production. These silos can impede the smooth sharing of crucial data, resulting in inefficiencies, redundant efforts, and delays in decision-making within the company.

It has been observed that when there's a lack of transparent and collaborative information exchange within the merged organization, departments can easily isolate themselves, focusing only on their individual objectives rather than the overall organizational goals. This lack of coordination undermines our ability to achieve operational excellence and take advantage of the synergies promised by vertical integration.

To tackle these communication hurdles, it's essential to nurture a culture of transparency and cross-functional collaboration. By dismantling information silos, we can promote the seamless flow of essential data, align strategic priorities, and empower our teams to innovate and streamline workflows. Overcoming these barriers is crucial for fully realizing the benefits of vertical mergers and enhancing our competitive position in the market.

Barriers to Entry for New Competitors

Vertical mergers can create significant barriers to entry for new competitors by consolidating control over multiple stages of the production process. By dominating critical areas of the supply chain, these mergers can restrict access to essential resources and production capabilities that emerging players need to compete effectively.

There are four key ways vertical mergers create barriers to entry:

- Supply Chain Consolidation: Vertically integrated firms can limit access to distribution channels, raw materials, and other inputs that new entrants require.

- Control Over Production: Owning multiple stages of the production process gives merged companies significant advantages regarding cost, quality, and efficiency over potential competitors.

- Competition Restrictions: Vertical mergers can reduce the number of independent firms in the market, stifling innovation and consumer choice.

- Economies of Scale: Large, vertically integrated companies enjoy significant scale economies that make it difficult for smaller players to match their prices and product offerings.

These barriers erected by vertical mergers pose real challenges for the kind of disruptive innovation that drives progress in many industries. Policymakers must carefully weigh the pros and cons when evaluating these types of business combinations.

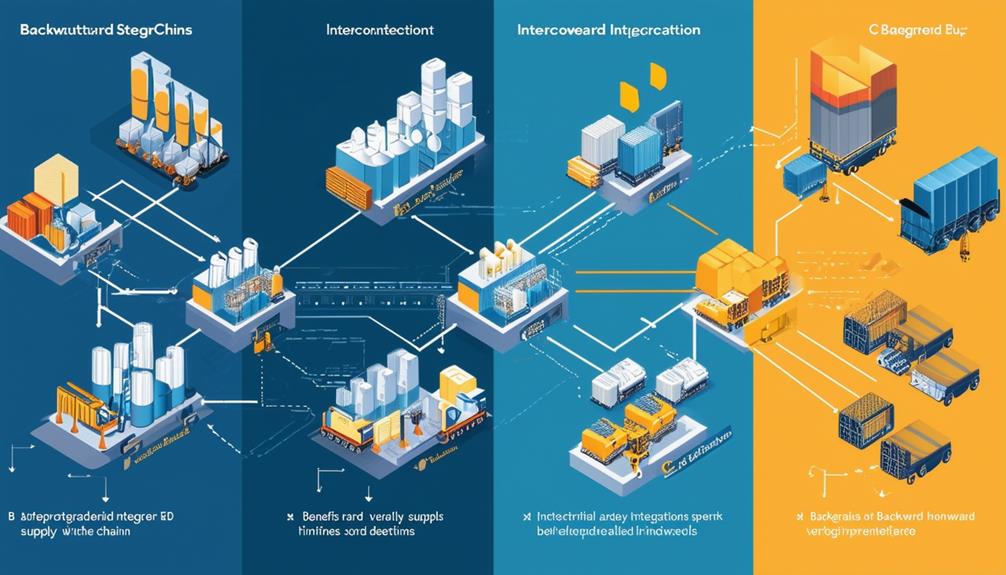

Backward Integration and Vertical Mergers

Vertical mergers allow us to pursue backward integration, giving us control over crucial resources, cutting costs, and improving supply chain efficiency. By merging with or acquiring suppliers or companies earlier in the supply chain, we can enhance our control over key materials and components. This streamlines production, ensures a stable supply, and reduces risks linked to external dependencies.

This strategy significantly decreases costs by cutting out middlemen, optimizing logistics, and benefiting from economies of scale. Moreover, it enables us to maintain a higher level of quality control by overseeing the manufacturing process directly and implementing best practices. Successful backward integration strengthens our competitiveness, boosts profitability, and enhances our strategic positioning in the market.

As we strive for innovation and industry leadership, vertical mergers for backward integration emerge as a powerful tool to reinforce our supply chain, increase control over our supply, and lower costs.

Forward Integration and Vertical Mergers

When companies engage in vertical mergers, they aim to strengthen their position in the market by integrating with downstream firms. This strategic move allows them to have better control over their supply chain and expand their reach to end consumers. By merging with or acquiring businesses in the distribution or retail sectors, companies can streamline their operations and improve efficiency.

Vertical mergers offer the merged entity a competitive edge by enhancing coordination and market reach. This consolidation of different stages of the supply chain can lead to cost savings and improved communication between the merged entities. It also enables the company to have a more comprehensive understanding of consumer preferences and market trends, allowing them to adapt their strategies accordingly.

Through forward integration in vertical mergers, companies can't only optimize their operations but also strengthen their market power. This increased control over the supply chain can help in reducing dependency on external suppliers and mitigating risks associated with disruptions in the supply chain. Ultimately, vertical mergers can lead to a more robust and agile business model that's better equipped to meet the demands of the market.

Enhanced Supply Control

Forward integration enables companies to directly control their distribution channels and sales processes, giving them enhanced supply authority. Through vertical mergers, firms can streamline operations, boost efficiency, and fortify their connections with customers.

Four key benefits of forward integration through vertical mergers include:

- Enhanced market insights and customer relationships, strengthening overall supply chain management.

- Reduced reliance on third-party distributors, enabling greater control over pricing and promotions.

- Improved management of branding and customer experience by owning retail outlets and sales channels directly.

- Increased operational efficiency by consolidating various supply chain functions within a single entity.

Increased Market Power

Vertical mergers enhance our market power by allowing direct control over distribution channels, eliminating intermediaries, and improving market operations. Through merging with entities in the distribution chain, we gain significant influence over pricing and market access, strengthening our competitive edge. This forward integration strategy boosts our market power, leading to increased profitability and broader customer reach.

By engaging in vertical mergers, we streamline operations, remove redundant processes, and achieve greater efficiencies. This operational efficiency, combined with our reinforced market position, provides a clear advantage over competitors. These efficiencies can benefit consumers by potentially leading to lower prices and enhanced product availability.

The increased market power obtained through forward integration vertical mergers offers a strategic opportunity to solidify our leadership and drive long-term success. As we explore innovative growth avenues, these mergers can play a crucial role in maintaining our competitive position and fostering sustained growth.

Balanced Integration and Vertical Mergers

Vertical mergers involve the joining of companies that operate at different stages of production or distribution within the same industry. This strategic move allows firms to consolidate their operations, reduce costs, and gain a competitive edge in the market. By merging with complementary businesses, companies can strengthen their market position and create synergies that drive growth and profitability.

Vertical mergers offer several benefits to companies, including enhanced control over the supply chain, improved efficiency, and the ability to respond quickly to market changes. By integrating upstream and downstream processes, firms can streamline operations, reduce lead times, and optimize resource allocation. This seamless coordination enables businesses to better meet customer demands and adapt to evolving market trends.

Furthermore, vertical mergers can lead to cost savings, as companies eliminate duplicate functions and leverage economies of scale. With increased visibility and coordination across different stages of production, firms can minimize transaction costs and improve overall operational performance. This enhanced control over the entire value chain allows companies to deliver products more efficiently and competitively in the marketplace.

Disintermediation and Vertical Mergers

Vertical mergers allow us to connect producers directly with consumers, cutting costs and improving efficiency. By eliminating middlemen, we can create a more streamlined and competitive business model. These mergers give us control over the entire production and distribution process, optimizing the flow of goods and information.

By embracing disintermediation, we can offer lower prices to consumers and strengthen our market position. This direct approach to supply chain management makes our system more agile and customer-oriented, helping us stay ahead of changing demands. Removing unnecessary intermediary steps promotes transparency and accountability across the value chain.

Disintermediation facilitated by vertical mergers is a valuable tool for driving innovation and operational excellence. By leveraging this strategy, we can uncover new ways to enhance our supply chain, boost efficiency, and provide enhanced value to our customers.

Degrees of Vertical Integration

Vertical mergers come in two main flavors – complete and partial. In a complete vertical merger, a company obtains or constructs all the necessary assets to oversee every step in the supply chain. Conversely, a partial vertical merger, also known as quasi vertical integration, involves alternatives such as minority stakes, joint ventures, and strategic partnerships.

Partial vertical integration offers several notable advantages:

- Requires less capital investment than full integration.

- Provides the flexibility to respond to shifts in the market.

- Enables the utilization of partners' specialized skills and resources.

- Shares risks with collaborators, fostering a sense of mutual responsibility.

Various industries, including telecommunications and oil and gas, often employ partial vertical integration tactics. For instance, Live Nation has embraced a partial vertical integration strategy by collaborating with Ticketmaster. Similarly, SpaceX has integrated segments of its supply chain through technology licensing agreements.

Full Vertical Integration

In the realm of mergers and acquisitions, vertical mergers entail the consolidation of companies operating at different stages of the same supply chain. This strategic move allows businesses to combine production, distribution, and sales processes under one umbrella, fostering greater control and efficiency. By integrating upstream and downstream activities, companies can streamline operations, reduce costs, and enhance coordination throughout the supply chain.

Vertical mergers offer a range of advantages, including enhanced quality control, economies of scale, and the elimination of intermediary margins. This consolidation enables companies to optimize processes, improve communication across departments, and strengthen their market position. However, it also comes with certain risks, such as the need for a substantial initial investment, potential inflexibility in adapting to market changes, and overreliance on internal capabilities.

Careful evaluation of the benefits and drawbacks of vertical mergers is essential for long-term success. When executed thoughtfully, this strategy can provide businesses with a competitive edge, cost efficiencies, and greater control over their operations. By leveraging the synergies between different stages of the supply chain, companies can drive innovation, enhance productivity, and position themselves for sustained growth in the market.

Quasi Vertical Integration

Vertical mergers allow companies to combine different stages of production or distribution under one ownership. This strategic move can lead to increased efficiency and control over the supply chain. It's a way for businesses to streamline operations and potentially reduce costs by integrating complementary activities.

One advantage of vertical mergers is the potential for improved coordination and communication between previously separate entities. By bringing together different parts of the value chain, companies can align strategies and goals more effectively. This can lead to faster decision-making and a more cohesive approach to serving customers.

Another benefit of vertical mergers is the ability to capture a larger share of the value created along the supply chain. By owning multiple stages of production or distribution, companies can capture profits that would have otherwise gone to third-party suppliers or distributors. This can lead to increased profitability and competitiveness in the market.

Vertical mergers also offer companies the opportunity to leverage their combined resources and capabilities to innovate and develop new products or services. By integrating different parts of the value chain, companies can access new technologies, expertise, and market insights that can drive growth and differentiation. This can give companies a competitive edge and help them stay ahead in a rapidly changing business environment.

Frequently Asked Questions

What Is Vertical Merger Advantages and Disadvantages?

Got it. Vertical mergers can bring about cost efficiencies and better integration within the supply chain, leading to improved overall performance. However, they also have the potential to stifle competition and reduce options for consumers. It's important to carefully weigh these pros and cons to make informed decisions about the future direction of the business. Let's delve deeper into these aspects to gain a clearer understanding of the situation.

What Are the Disadvantages of Vertical Combination?

We understand the drawbacks of vertical mergers, such as diminished economies of scale, communication hurdles, heightened complexity, and restricted flexibility – all of which can impede progress and innovation. It's crucial to carefully evaluate these factors when contemplating vertical integration.

What Are the Advantages and Disadvantages of Vertical Collaboration?

Vertical collaboration, particularly in the form of mergers, offers numerous benefits such as streamlining processes, increasing revenue and productivity, improving management efficiencies, and gaining access to superior resources. These mergers can lead to synergies that result in cost savings and operational improvements, ultimately enhancing the overall performance of the combined entities. In the realm of mergers and acquisitions, vertical integration can provide a competitive edge by allowing companies to control more stages of the supply chain, from production to distribution.

However, it is important to be mindful of the potential drawbacks of vertical mergers. One significant concern is the risk of reduced competition in the market, which could result in higher prices for consumers and less innovation among competitors. Additionally, there is a possibility of facing antitrust violations if the merged entity becomes too dominant in a particular industry, leading to regulatory scrutiny and potential legal consequences.

What Are the Problems With Vertical Mergers?

We've grasped the key issues with vertical mergers. They can stifle market competition, restrict consumer options, and result in excessive industry consolidation – a significant obstacle to innovation and advancement.

Conclusion

Vertical mergers involve the consolidation of two companies operating at different stages of the same supply chain. This type of merger typically occurs when a company acquires a supplier or distributor in order to streamline operations and reduce costs. By integrating different parts of the production process under one roof, companies can potentially achieve greater efficiency and control over their supply chain.

One of the main advantages of vertical mergers is the potential for cost savings. By bringing together different stages of production, companies can eliminate the need for intermediaries and reduce transaction costs. This can lead to lower prices for consumers and higher profits for the merged entity. Additionally, vertical integration can help companies secure a stable supply of key inputs and reduce the risk of supply chain disruptions.

On the other hand, vertical mergers can also raise concerns about market power and anticompetitive behavior. When a company controls multiple stages of the supply chain, it may have the ability to limit competition and raise prices for consumers. This can be particularly problematic if the merged entity becomes dominant in a particular market, leading to reduced choices for consumers and potentially higher prices.

Overall, vertical mergers can offer benefits in terms of efficiency and cost savings, but they also raise potential risks related to market power and competition. It's important for regulators to carefully assess the potential impact of vertical mergers on competition and consumer welfare to ensure a level playing field in the market.