Navigating Tax Implications in Stock Mergers

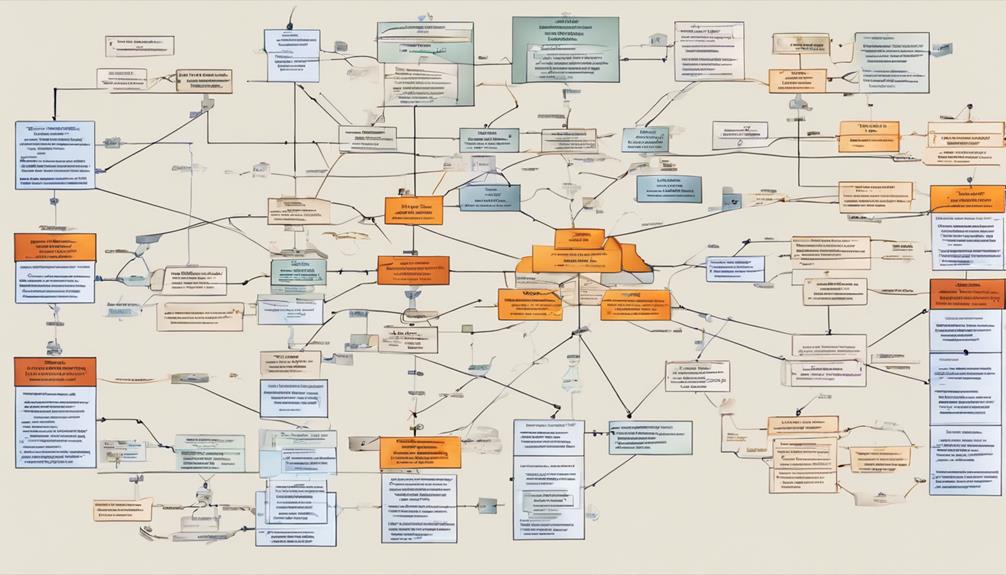

To comprehend the tax implications of stock mergers, it's crucial to adopt a strategic approach. A comprehensive assessment of the taxable income implications, basis adjustments, and utilization of acquired tax attributes is essential for optimizing outcomes.

Careful scrutiny of the entity structure, regulatory compliance, and tax return filing requirements is vital in this process. Thorough tax due diligence and accurate allocation of the purchase price are pivotal steps to ensure a smooth transition.

By streamlining the tax integration and maintaining ongoing tax management, we can guarantee a seamless and tax-efficient shift. Explore this detailed guide further to maximize the full potential of your stock merger.

Key Takeaways

When it comes to stock mergers, it's important to understand the tax implications that come along with them. By knowing how taxable income is affected, making necessary cost basis adjustments, and considering tax attribute carryovers, you can optimize your tax outcomes.

It's also crucial to identify the entity structure involved in the merger and ensure compliance with post-merger regulatory requirements. This includes taking care of short-period tax filings and considering employment tax implications.

To navigate the tax landscape effectively, make sure to file all necessary tax forms such as Form 8832, Form 8594, and Schedule O. Strategic tax elections can also help minimize your tax liabilities in the long run.

Conducting thorough tax due diligence is key to uncovering any hidden tax liabilities and allocating the purchase price effectively for tax compliance and efficiency. This will help streamline the tax integration process and ensure smooth operations post-merger.

By tracking balance reversals, addressing employment tax issues, and managing ongoing tax considerations like cost basis adjustments and dividend income tracking, you can stay on top of your tax obligations and make the most of your stock merger.

Understanding Taxable Income Implications

Understanding the tax implications of stock mergers is crucial. The taxable income implications stem from the realized gain or loss upon the sale of stock. To calculate this, we subtract the original cost basis from the selling price. The application of capital gains tax depends on the holding period and tax bracket.

Navigating the tax consequences of stock mergers involves careful consideration of adjustments affecting the cost basis. These adjustments can significantly impact the calculation of taxable income, making it essential to remain vigilant.

Accurate reporting and adherence to tax laws are essential to avoid penalties and ensure a seamless transaction.

Basis Adjustments in Stock Mergers

In stock mergers, it's crucial to adjust the basis of the acquiring company's stock to account for the total merger consideration. This adjustment is important for determining the tax implications in the future.

The adjusted basis is calculated by subtracting the original stock purchase price from the total merger consideration. This calculation helps to identify the unrealized gains in the acquiring company's stock.

After the merger is finalized, the realized capital gains can be calculated by comparing the adjusted basis to the original purchase price. Having a solid grasp of these basis adjustments is key to effectively navigating the tax implications in stock mergers.

Different types of mergers and acquisitions can impact the basis adjustments in varying ways. For example, a horizontal merger between two companies in the same industry may result in different basis adjustments compared to a vertical merger between companies in different stages of the supply chain.

Understanding the specific dynamics of the merger at hand is essential for accurately adjusting the basis of the acquiring company's stock.

Carryover of Tax Attributes

In a stock merger, it's crucial to manage the carryover of the target company's tax attributes, such as net operating losses and tax credits. The merger agreement must be carefully structured to ensure these valuable tax benefits smoothly transfer to the acquiring company.

By utilizing the target's tax attributes, we can significantly reduce the future tax liabilities of the combined entity and improve the overall financial performance of the merged organization.

Stock mergers involve the exchange of shares between the acquiring and target companies, allowing for a seamless transfer of ownership and control. This type of merger typically results in the target company becoming a subsidiary of the acquiring company, with the shareholders of the target company receiving shares in the acquiring company.

By structuring the merger agreement effectively, the acquiring company can take advantage of the target company's tax attributes to offset future taxable income and reduce tax liabilities. This strategic approach can result in significant cost savings and enhanced financial performance for the merged entity in the long run.

Overall, properly managing the carryover of tax attributes in a stock merger is essential for maximizing the benefits of the transaction and ensuring a smooth transition for both companies involved.

Carryover of Net Operating Losses

When engaging in a stock merger, one valuable advantage we can tap into is the opportunity to make use of the acquired company's net operating losses (NOLs) to offset our future taxable income. This strategic tax approach enables us to leverage the NOLs accumulated by the acquired firm, which can be carried forward for up to 20 years following the merger. By employing this method, we've the ability to significantly decrease our tax obligations and improve our overall cash flow—a critical factor in the success of any merger.

To fully capitalize on the benefits of NOL carryovers, it's essential to meticulously plan and coordinate our actions. Ensuring proper documentation and adherence to IRS regulations is crucial to seamlessly integrating the acquired company's tax attributes into our financial reporting. This level of precision will allow us to unlock the complete potential of the NOL carryovers, reinforcing our competitive edge and fostering innovation in the market.

Preservation of Tax Basis

Preserving the tax basis of the target company's assets is crucial in a stock merger. By maintaining the original cost basis, we can continue to depreciate or amortize those assets at their initial values, leading to significant tax savings for the acquiring company.

Furthermore, the retention of tax attributes such as net operating losses (NOLs) and tax credits from the target company is a valuable advantage of this approach. By safeguarding these important tax attributes, we can offset future taxable income, further reducing the tax burden on the acquiring company.

Ensuring the proper preservation of tax basis in a stock merger necessitates thorough planning and adherence to tax regulations. Collaborating closely with tax professionals is essential to maximize the potential tax benefits. This strategic approach not only enhances the financial performance of the acquiring company but also showcases our dedication to fiscal responsibility and long-term value creation.

Leveraging the preservation of tax basis serves as a potent tool in navigating the intricate tax landscape of stock mergers.

Transfer of Tax Credits

When considering stock mergers, it's crucial to think about not only preserving tax basis but also the transfer of tax credits. Acquiring companies can benefit from carrying over valuable tax attributes like research and development credits or investment tax credits from the target company to offset their own future tax liabilities.

This transfer of tax credits requires careful documentation and compliance with relevant regulations to ensure a seamless transition.

Proper documentation and adherence to compliance requirements are vital for maximizing the advantages of transferred tax credits. Understanding the regulations and restrictions related to tax credit transfers allows acquiring companies to strategically incorporate these assets into their overall tax planning.

This strategic approach can result in a decreased tax burden and enhanced financial position for the combined entity.

Successfully navigating the complexities of tax credit transfers in stock mergers demands a deep comprehension of the applicable laws and regulations. By proactively addressing this crucial aspect, acquiring companies can unlock the full potential of these tax attributes and position themselves for long-term success.

Calculating Taxable Income Pre and Post-Transaction

Calculating taxable income before and after a stock merger or acquisition is crucial for ensuring tax compliance and minimizing liabilities. Understanding the income, deductions, and credits before the transaction sets the stage for assessing the potential tax impact of the merger or acquisition.

After the transaction, the calculation takes into account changes in assets, liabilities, and ownership structure, providing a clear view of the new tax scenario.

Analyzing the disparities in taxable income before and after the transaction is essential for meeting tax requirements and planning effectively. It helps identify any shifts in tax obligations, allowing companies to stay on the right side of the law and make well-informed decisions.

Precise calculations play a critical role in reliable financial reporting and strategic tax planning throughout the stock merger or acquisition process.

Analyzing Legal Entity Organizational Structure

As we analyze the legal entity organizational structure after a stock merger, we need to review the pre- and post-acquisition entity charts to ensure compliance with tax regulations. Understanding how stock mergers impact taxable income calculations for both periods is crucial.

We may encounter difficulties in tracking and reversing transaction date balances, so it's important to be thorough in our examination.

It's also essential to consider the different tax implications between stock deals and asset deals. This includes evaluating employment tax considerations such as payroll and FICA taxes to ensure that we remain in compliance with regulations.

Identifying Entity Structure

Understanding the legal entity organizational structure is crucial when analyzing the tax implications of a stock merger. Identifying both the pre- and post-acquisition entity structure allows for a thorough assessment of taxable income over different periods. It also enables accurate tracking of balances as of the transaction date and effective management of tax compliance.

Distinguishing between stock deals and asset deals is key to evaluating taxable income post-transaction. Recognizing the combination of basis and step-up events in multiple target entity acquisitions further aids in navigating the complexities of tax compliance.

In a stock merger scenario, the pre-acquisition entity structure typically consists of a standalone target company that operates as an independent legal entity. Post-acquisition, the target company becomes a subsidiary of the acquiring company, integrated into its overall structure. This transition often involves moving from separate reporting and tax filings to consolidated reporting and tax filings, potentially resulting in shared taxable income.

Regulatory Compliance Implications

Understanding the regulatory compliance implications post-stock merger is crucial for ensuring legal adherence. Monitoring the transition from separate reporting and tax filings to consolidated reporting is essential as it can significantly impact the company's taxable income. It's also important to differentiate between stock deals and asset deals to accurately assess the tax implications involved.

Tracking the reversal of balances at the transaction date becomes a significant challenge after a stock merger. Analyzing short-period tax filings and considering employment tax implications are vital steps in maintaining regulatory compliance. By comprehensively understanding the organizational chart before and after the acquisition, changes in taxable income can be effectively monitored to meet tax compliance requirements.

Incorporating these strategies into the post-merger integration process will help navigate the complex tax landscape and ensure the company's standing with regulatory authorities. Being proactive and vigilant in managing regulatory compliance implications is key to a successful stock merger.

Short-Period Tax Filings Post-Merger

When a company acquires another outside its usual tax year, it becomes necessary to file short-period tax returns. These filings cover the periods before and after the acquisition, ensuring accurate reporting of income, expenses, and taxes during these distinct time frames. Separating the data in this manner is crucial for transparency and compliance with relevant tax laws.

Handling short-period tax filings properly is vital for fulfilling post-merger obligations. It requires careful tracking of financial information and accurate reporting to the appropriate authorities. Failure to do so can result in significant penalties and harm to the company's reputation.

In the realm of stock mergers, navigating tax implications can be complex. Short-period filings play a key role in ensuring a smooth transition and safeguarding the financial integrity of the company.

Employment Tax Implications of Mergers

When it comes to mergers, there are various types that can impact employment tax obligations. One common type is a stock merger, where one company buys another company's stock, making it the new owner. In this scenario, the acquiring company assumes all the assets and liabilities, including any existing tax liabilities related to employment.

Stock mergers can have significant implications for employment tax compliance. Companies involved in a stock merger must ensure that their payroll systems are seamlessly integrated to handle tax withholdings in accordance with federal, state, and local regulations. This integration is crucial to avoid any penalties or non-compliance issues post-merger.

Furthermore, FICA tax considerations play a role in stock mergers. Changes in employee headcount and compensation structures resulting from the merger can impact Social Security and Medicare tax contributions. It's essential for employers to manage these changes effectively to stay compliant with employment tax laws.

Employee tax withholding is another area that may need attention during a stock merger. Companies may need to review and update their withholding policies to reflect any changes in employee status, benefits, or other factors post-merger. Ensuring accurate withholding is key to avoiding any issues with tax authorities.

Changes in Tax Year Due to C Corporation Acquisitions

When a C corporation is acquired, it can lead to the need for filing short-period tax returns due to potential changes in the standard tax year structure. The acquisition of a C corporation might result in a shift in the tax year, requiring adjustments to ensure compliance with tax laws. This shift can add complexity to tracking taxable income for periods before and after the transaction.

In the case of stock deals involved in C corporation acquisitions, the situation can become even more intricate. It's crucial to closely monitor the legal entities' organizational chart both pre- and post-acquisition to ensure accurate tax compliance. Failure to do so could have implications for employment taxes, such as payroll tax and FICA tax, which must be carefully evaluated following the merger.

Understanding these changes in the tax year structure and the corresponding reporting obligations is essential for ensuring a seamless process. Proactively addressing these tax implications can assist our clients in staying compliant and reducing the potential for costly mistakes.

Compliance With Tax Forms and Elections

Navigating the intricate landscape of stock mergers requires careful attention to compliance with crucial tax forms such as Form 8832 and Form 8594. Understanding the tax implications outlined in Form 1120 and assessing the effects of elections like Section 338(h)(10) are essential for ensuring a seamless transition post-merger. Effective communication and timely submission of tax forms like Schedule O can significantly impact the smooth progression of this critical process.

In the realm of stock mergers, it's imperative to stay vigilant about adhering to the necessary tax documentation. Form 8832, for instance, plays a significant role in determining the tax classification of the merged entity, influencing tax obligations and liabilities. Similarly, Form 8594 is crucial for reporting assets acquired in the merger, providing clarity on the allocation of purchase price for tax purposes.

Furthermore, comprehending the tax implications laid out in Form 1120 is key to managing the post-merger tax landscape effectively. Evaluating the consequences of elections such as Section 338(h)(10) can have a substantial impact on the taxation structure of the merged entity, potentially optimizing tax benefits and liabilities. Ensuring accurate and timely filing of tax forms like Schedule O is essential for maintaining compliance and facilitating a smooth transition during the merger process.

Filing Tax Returns

Understanding the different types of mergers and acquisitions is crucial in the realm of tax filing post-merger. Various forms and disclosures play a significant role in ensuring compliance and accuracy in reporting requirements following a merger. Let's delve into the key forms and their importance in the tax filing process.

In a stock merger scenario, Form 8832 becomes essential as it allows for the election of a new entity classification for tax purposes. This form enables the merging entities to choose how they want to be taxed post-merger, which can have a significant impact on their tax liabilities and benefits.

Another critical form in the tax filing process post-merger is Form 8594. This form is necessary for reporting asset acquisitions in stock mergers, helping to allocate the purchase price among the different assets involved. Accurately determining the allocation of purchase price is important for calculating depreciation and tax implications going forward.

Following a merger involving C corporations, Form 1120 comes into play for reporting income, deductions, and credits. This form is specifically designed for C corporations and is used to calculate the tax liability of the merged entity based on its post-merger financial activities.

Lastly, Schedule O is a vital component for disclosing post-merger ownership changes and other relevant information to the IRS. This schedule helps ensure transparency and compliance with reporting requirements, providing the IRS with a clear understanding of the changes that have occurred due to the merger.

Election Requirements

Understanding and complying with critical tax forms and elections is essential to ensure a smooth post-merger tax filing process in a stock merger. Completing Form 8832 to make entity classification elections and submitting Form 8594 to properly allocate the purchase price in asset acquisitions are key steps.

For C corporations, filing Form 1120 is necessary to report income and deductions after a merger. In some instances, organizations may also need to file Schedule O to disclose changes affecting their tax status.

Adhering to these election requirements is crucial for successful post-merger tax compliance. Failure to meet these obligations can result in costly penalties and delays, potentially jeopardizing the overall success of the merger.

Staying informed and proactive will help organizations navigate the complex tax implications of stock mergers, positioning themselves for a seamless transition and a strong financial foundation going forward. Attention to detail and a commitment to compliance are essential for effectively managing the tax considerations inherent in any merger or acquisition.

Optimizing Tax Outcomes Post-Merger

To optimize tax outcomes post-merger, it's crucial to carefully consider the merger consideration value and new cost basis in the acquiring company's stock. These factors play a significant role in accurately calculating realized capital gains after a stock merger.

Here are four key steps to navigate the tax implications effectively:

- Calculate the new cost basis by combining the original purchase price with any cash received instead of fractional shares.

- Examine the tax treatment of the merger consideration, whether it involves solely stock, a combination of stock and cash, or other payment forms.

- Analyze the timing of the merger and its impact on distinguishing between long-term and short-term capital gains, as this can substantially affect your tax responsibilities.

- Seek advice from a tax professional to ensure the implementation of proper tax planning and M&A tax strategies aimed at minimizing tax liabilities.

Importance of Tax Due Diligence

Tax due diligence is crucial in stock mergers to uncover any hidden tax liabilities, assess compliance, and identify potential tax risks. By evaluating the historical tax positions of the involved companies, we can determine any outstanding tax obligations or issues that could impact the merger. This meticulous approach ensures that all parties are informed of any contingent tax liabilities, essential for smooth post-merger tax compliance.

Furthermore, identifying pending audits or tax disputes through due diligence allows us to anticipate potential tax liabilities post-merger.

Thorough tax due diligence guarantees optimized tax efficiencies and a seamless process during the stock merger. It's imperative to conduct a comprehensive examination to mitigate risks and ensure compliance with tax regulations. By delving into the tax implications upfront, companies can proactively address any issues and streamline the merger process.

Purchase Price Allocation Considerations

When going through a stock merger, it's crucial to carefully allocate the purchase price to different assets. This decision has a significant impact on the company's future tax deductions, depreciation, and amortization. The proper allocation of the purchase price is essential for ensuring tax efficiency and maximizing potential tax benefits.

There are four key considerations to keep in mind when allocating the purchase price in a stock merger:

Firstly, it's important to accurately determine the fair market value of tangible assets like equipment, real estate, and inventory. This helps establish the correct cost basis and depreciation schedule for these assets.

Secondly, identifying and valuing intangible assets such as patents, trademarks, and customer relationships is crucial. This step helps in determining the amortization period and optimizing tax outcomes related to these intangible assets.

Thirdly, allocating the right amount to goodwill is significant. Goodwill represents the premium paid over the fair market value of net assets and can have a substantial impact on the company's future tax liabilities.

Lastly, detailed purchase price allocation is essential for tax compliance. It ensures that the company adheres to tax regulations and can optimize its tax position post-merger.

Post-Transaction Tax Compliance and Integration

In the realm of post-transaction tax compliance and integration, it's crucial to prioritize meeting regulatory obligations. The focus should be on streamlining the tax integration process to accurately track balances and reverse transaction date entries. By addressing state, local, and foreign tax implications, a seamless post-merger transition can be facilitated.

When it comes to stock mergers, understanding the different types of mergers and acquisitions is essential. A stock merger involves the merging of two companies where one company's stocks are exchanged for the other company's stocks. This type of merger can have various implications for tax compliance and integration processes.

In the context of post-transaction tax compliance and integration, it's important to consider the specific tax implications that come with a stock merger. These can include issues related to capital gains taxes, stock basis adjustments, and potential tax liabilities. By being aware of these factors and addressing them proactively, companies can navigate the post-merger landscape more effectively.

Regulatory Compliance Obligations

Analyzing the merger/purchase agreement and examining pre- and post-acquisition organizational charts are crucial steps in ensuring proper post-transaction tax compliance. Understanding the tax implications of stock deals and asset acquisitions is essential for calculating taxable income both before and after the transaction.

When it comes to regulatory compliance obligations, a comprehensive approach is needed:

- Assessing state, local, and foreign tax implications after a merger, which includes considerations for transfer pricing and adherence to local country tax laws.

- Reassessing the tax basis of acquired assets to fair market value and properly allocating the purchase price to assets and intangibles during the asset acquisition process.

- Handling important elections, tax forms, and debt considerations after an acquisition, such as the carryover of tax attributes, new debt responsibilities, and ensuring timely submission of necessary tax forms to meet compliance requirements.

- Keeping abreast of changing regulations and industry best practices to uphold a strong tax compliance strategy throughout the transaction lifecycle.

In the context of stock mergers, it's crucial to consider the impact on tax obligations and compliance requirements to ensure a smooth transition and adherence to regulatory standards. By following these steps and staying informed about tax laws and practices, companies can navigate the complexities of mergers and acquisitions while maintaining compliance with tax regulations.

Streamlining Tax Integration

Understanding the tax implications of stock mergers and acquisitions is crucial for ensuring seamless post-transaction compliance and preventing costly errors. It's essential to meticulously track balance reversals as of the transaction date, allocate the purchase price accurately to assets and intangibles, and address any employment tax considerations to remain in line with regulations. This intricate process demands a deep understanding of tax laws and regulations to navigate effectively.

The intricacies of stock options and deferred compensation arrangements play a significant role in determining taxable income both before and after the transaction. Proper documentation of organizational structure and ownership changes is equally vital to ensure precise tax reporting and avoid potential penalties. By grasping these nuances, companies can streamline the tax integration process following a merger or acquisition successfully.

Stock mergers represent a type of corporate combination where two companies consolidate their stock into a new entity. This form of merger can lead to various tax implications and requires careful consideration to optimize the integration process. Companies undertaking stock mergers must take into account not only the financial aspects but also the legal and regulatory frameworks governing such transactions.

Ongoing Tax Management and Monitoring

We continuously monitor cost basis adjustments and realized gains to effectively manage our tax obligations following a stock merger. It's essential to keep a close eye on any changes in stock value and dividends received to ensure accurate tax reporting.

By identifying potential holding period adjustments and adhering to wash sale rules after a stock merger, we strive to maintain compliance and optimize our tax outcomes. Additionally, we consistently assess dividend income and capital gains from our stock holdings to facilitate strategic tax planning.

Our approach to ongoing tax management and monitoring encompasses tracking cost basis adjustments and realized gains, monitoring stock value and dividends, identifying holding period adjustments and wash sale rules post-merger, and evaluating dividend income and capital gains for effective tax planning.

Frequently Asked Questions

How Are Stock Mergers Taxed?

During a stock merger, it's essential to consider various tax implications. This includes capital gains, dividend taxes, basis adjustments, and shareholder reporting duties. Understanding these aspects can help us navigate the complex tax environment and optimize the benefits we receive from the merger.

Stock mergers can take different forms, such as a cash merger, stock-for-stock merger, or a mixed merger. Each type of merger may have different tax consequences for shareholders. For example, in a stock-for-stock merger, shareholders may receive shares in the acquiring company, which could lead to potential capital gains taxes if they decide to sell those shares in the future.

It's important to consult with tax professionals or financial advisors when dealing with stock mergers to ensure compliance with tax laws and maximize the advantages of the merger for shareholders. By staying informed and proactive in managing our tax responsibilities during a stock merger, we can make the most of the opportunities presented by this corporate event.

What Are Some Tax Implications That Should Be Considered When a Company Is Considering a Merger or Acquisition?

Did you know that 70% of mergers fail to achieve their intended goals? When considering a merger, it's essential to assess the tax implications to ensure a successful outcome. These considerations may include the basis step-up, change of control, treatment of deferred tax assets, and transaction costs.

In a stock merger, one company purchases another company's stock, allowing the acquiring company to gain control of the target company. This type of merger can have significant tax implications, such as potential tax benefits from a step-up in the basis of the acquired company's assets. This adjustment can result in higher depreciation and amortization deductions for the acquiring company, reducing taxable income.

Additionally, a change in control due to a merger can trigger the recognition of deferred tax assets or liabilities. These assets or liabilities may need to be revalued based on the new ownership structure, potentially impacting the financial statements and tax obligations of the merged entity.

Transaction costs, including fees for legal, accounting, and advisory services, are also important to consider in a merger. These costs can be significant and may be deductible over time, affecting the overall tax implications of the transaction.

How Do Taxes Work in M&A?

To effectively manage taxes in M&A, it is crucial to consider cost basis adjustments, reporting requirements, the impact on deferred taxes, and the timing of merger closing. These complexities play a significant role in driving innovation in transactions.

When it comes to types of mergers and acquisitions, one common approach is a stock merger. In a stock merger, the acquiring company purchases the target company's shares, often resulting in a more streamlined integration process. This type of merger can have implications for tax management, as it may trigger adjustments to the cost basis of the acquired shares.

Properly addressing these considerations can lead to more efficient tax planning and execution during mergers and acquisitions. By understanding the nuances of stock mergers and other types of transactions, companies can navigate the tax implications effectively and optimize their financial outcomes.

What Are the Tax Implications of a Stock Buyout?

When a company acquires our shares, we need to consider the tax implications that come with it. This includes looking at capital gains liabilities, dividend tax impacts, and withholding tax considerations. It's important to think about how this transaction will affect our finances and how we can plan accordingly.

One important aspect to consider is the type of merger or acquisition taking place. There are different types, such as horizontal mergers where companies in the same industry combine, or vertical mergers where companies in different stages of the supply chain merge. Each type can have different tax implications, so it's crucial to understand the specifics of the deal.

In the case of a stock merger, where two companies combine through the exchange of stocks, there may be tax consequences for shareholders. It's essential to be aware of any potential capital gains taxes that may arise from the transaction. Additionally, if the acquiring company pays dividends to shareholders, there could be tax implications related to those dividends as well.

Estate tax planning can also play a significant role in navigating the tax implications of a stock buyout. By carefully planning our estate and considering how the buyout will impact our financial future, we can make the most of the transaction and ensure that our assets are managed efficiently.

Conclusion

Understanding the intricate tax implications of stock mergers is crucial for businesses. Research shows that more than 60% of companies underestimate the tax costs linked to mergers and acquisitions. By delving into the details of basis adjustments, tax attribute carryovers, and post-transaction compliance, we can ensure a seamless and tax-efficient transition for our clients.

Stock mergers come in various forms, such as horizontal mergers where companies in the same industry combine, or vertical mergers where firms along the supply chain merge. Each type of merger can have different tax implications based on how the transaction is structured and the assets involved.

When it comes to stock mergers, it's essential to consider factors like the tax basis of the acquired company's assets, any carryover tax attributes like net operating losses, and potential tax consequences for shareholders. By carefully analyzing these elements, businesses can better prepare for the tax implications of a stock merger and avoid unexpected financial burdens.

In conclusion, a thorough understanding of the tax implications of stock mergers is crucial for businesses looking to engage in M&A activities. By staying informed about basis adjustments, tax attribute carryovers, and compliance requirements, companies can navigate the complexities of stock mergers more effectively and ensure a successful transition for all parties involved.